In this article, I will explore why Hirequest could be a hidden growth opportunity in the US market. Despite flying under the radar, the company has shown promising signs over the past three years, with sales and EBIT compounding at impressive rates of 40% and 27.3% CAGR respectively. This might be just the beginning for the company.

Hirequest presented its results for the year 2023 last week. Total revenue was $37,9m, up 22,4% YoY. This growth looks good but is not impressive. They nevertheless manage to do well when looking at the US economy and keeping in mind how sensitive the staffing industry is to the construction cycles. 2022 is a tough comparison year because there were a lot of companies looking for workers and not enough available workforce, so temporary workers were hired.

In 2023 we have seen higher interest rates, which hurts the main client of the staffing industry, the construction sector. The labor market has also stabilized, and we keep looking at a very low rate of unemployment.

Overall, there has been an organic decline of approximately 10% in the industry.

Despite the revenue growth, the decline in profitability has been substantial. Net income has been $6,1m versus $12,5m last year. This is a net margin of 17% versus last year’s 39%, and 52% the year before that. A year with 2021 margins would have meant almost $20m in net income, which with today's market cap means 8,7x P/E.

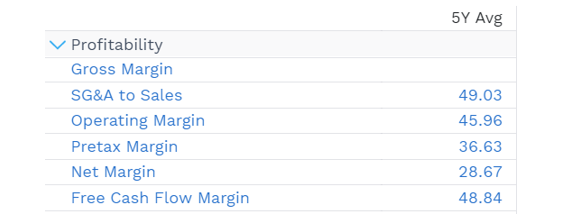

My main reasons for investing in this company with a sizable position are dual:

The decline in margins is temporary in nature and normalized net margins should be near the 50% mark.

The franchise model that Hirequest has implemented is asset light by nature. This allows them to produce enough cash during low parts of the cycle to keep acquiring companies and take advantage of a suffering sector, as is the staffing industry.

What are Hirequest´s normalized margins?

Hirequest is a franchise. There model, which has been run by Richard Hermanns for decades now (he was doing it before going public), implies acquiring small staffing companies across the US and franchising them. Normally there will be a gross price paid and a net price paid. The difference between the two is the selling price of some of the assets acquired to the new franchisee. Basically, they are going around buying family-owned businesses, a lot of times in trouble, and either letting them run it (by selling them back the franchise) or putting one of their proven franchisees in. Either way the result is that they will on average earn a 6% royalty. Those royalties are basically what conforms HQI revenues.

Why the family-owned business or anyone would be willing to sell and be franchised? Well, the first part is obviously getting some cash in. In most cases, the owners are also operators. Even if HQI buys a business and lets the old management to stay running it, they are getting some cash for it.

But the main reason is other. HQI will finance your payroll (by keeping your receivables in their balance until they get paid the royalty), will lower your workers´ comp (due to scale they get a better price on insurance), and will give you the back-office software. They are basically coming in and financing and providing tech support to your operations.

They will implement a risk management program (to reduce workers comp) and an incentive program for their franchisees to grow organically. If you are the manager of a staffing company, you will be the owner-operator of the business with guaranteed financing on your tight payroll. Also, you will have the possibility to earn more money than in a corporate entity that integrates its staffing sites. There are some franchisees now with +10 locations probably earning multiple million dollars a year.

Why am I telling you all of this when I was going to talk about margins? Just to conclude that total costs for HQI are almost equal to SG&A. Everything else at the corporate level is them financing some part of the operating system of their franchisees.

Except for workers ‘comp in 2023, which spiked due to underfunding (I will talk about it below), default rates on their financing of franchisees are negligible, plus they have franchisee´s receivables as collateral.

SG&A costs for the year 2023 were $24,4m versus $12,9m the year before. You would think something like a 20% to 30% increase would be normal given that they acquired some companies, so more people, some integration costs…But a 2x? The reason is they messed up a little bit with their biggest acquisition, MRI.

When you acquire a staffing company you are buying mainly receivables and a customers list. Any accrued payroll will be an assumed liability. The reason why the model works is that most times the old management that has built relationships with those customers over the years, stays at the company. In the staffing industry, customer-built relations are where the money is.

Apart from that, staffing companies will normally have a workers’ compensation deposit or liability. This cash account is based on estimated workers’ comp to be paid in the future. In 2022 they had a net benefit of $1,9m from workers comp (acquiring companies that have more designated cash than needed). In 2023, they had a workers’ comp expense of $3,7m… a $5,6m difference. It appears that MRI had way higher workers’ comp to be paid than expected.

I do not want to incur in drama talking, but the CFO, who came from an investment bank (he helped in the reverse merger in which Hirequest became public) left its place to a more veteran CFO, Steven Crane, with experience in the industry. I think this was mainly because of the unexpected high workers’ comp that came with the last acquisition. This is pure speculation as there have been no insights bout the change from management.

Without this cost, imaging that it was $0m, they would have had a net margin of approximately 31%.

I know, I said 50% normalize margins. Well, the 50% should be achievable in a no-acquisition scenario. They have used a credit line to make acquisitions and they usually pay interest within a few quarters, but you still get some interest expense ($1,3m in 2023).

Also, their insurance premiums were renegotiated in March, with management commenting that they were too high.

“So I'm not saying that we're going to -- as we pointed out, there's about a $3.6 million net expense. And obviously, that's not something we can obviously sustain or want to sustain. And so I think that the new structure will allow us to recover somewhere around half of that.”

All quotes are from the Q&A transcript of the FY23 results.

Let's say, because they are planning to keep acquiring companies, that they will have 30%-40% net margins going forward. You can move around numbers of workers’ comp, some inflation in salaries, integration costs and interest expense to arrive at some point in between that range.

They are paying around $3m per year of their $14m currently used line of credit. They can pay it faster (they pay $3m dividends a year and have acquired $76m worth of businesses in the last 3 years), while they will generate $15m-$20m of operating cash flow assuming no acquisitions, but I expect them to keep doing acquisitions during 2024, which leads me to answer the second point of why I invested in this company.

Why the Hirequest model works? A cyclical acquirer

There is a nuance to this question. The Hirequest model does not work if you are an investor and must provide good returns quarter to quarter. I don´t know what will happen with the US economy in the following quarters, or years for that matter. I do know that we are in the down part of a cycle where staffing companies are hurting and balances for your average mom-and-pop must be stretched.

If anyone finds comfort in it, the expectation is for modest growth in 2024.

With the current situation, what makes sense is to acquire. And this is what the CEO, Richard Hermanns, said during the Q&A of FY23 results:

“There's always plenty of acquisition opportunities up there, out there. It's always about price. There are -- I would just simply say that there's probably a bit more distressed properties available now. That doesn't mean they're going to sell for what they should sell saying for what they should sell because you still have people looking at a longer time frame and thinking that they're worth what they were in 2022. But I believe that there will be no shortage of opportunities. If the staffing and recruiting industry doesn't recover by the second half of this year, like I said, I suspect that there will be a fairly pretty strong increase in opportunities at realistic prices.”

You can smell the value investor in him. They are not overpaying and their returns on invested capital are impressive. Cash Flow return on Invested Capital was 17% in 2023 (issues mentioned), 30% in 2022 and 40% in 2021.

It does no good if you can smell blood on the streets and have no dry powder to take advantage. But the franchise model provides just that:

“And so we are generating nice amounts of cash flow. And while many of our peers have lost money in '23, we remain profitable the same way we did during the pandemic, and we're set up great for the future.”

The best part is that the acquisition of 2023 and probably the ones in 2024 will look good but not great. If you look at the 17% cash flow return on invested capital, is a nice number, but you are looking at returns on depressed earnings. Basically, the company you bought has done worse after you bought it. But if/when the economy turns, suddenly your ROIC numbers start looking better when keeping in mind the price paid and growing earnings of the business acquired.

The combination of organic and inorganic growth can generate very good returns going forward. Remember that they have grown topline 20% in 2023 with a 10% decrease in the overall market.

I don´t know when that will happen, but the expansion of margins is a certainty at some point in the future. Even if they keep acquiring, net margins should be in the 30%-40% range. With no growth, that means $38m of revenue, so $11,4m of net income on the low end. That is a 14x P/E, being obviously my bear case given that they grew 20% last year in a bear market.

I believe they might be able to grow 20% if they keep acquiring during 2024, with 30% margins (due to integration costs and interest expense), which can mean around $14m of net income with no organic growth. A 12 P/E. I do not see this company being cheaper than that at any point in time.

Now, in the remote scenario where they do not find opportunities to deploy capital, margins can go up to the 40%-50% range. In the low end that is $15m of earnings, or 11 P/E.

If we look past next year, it gets tricky. It is very difficult to calculate the potential growth of a company like Hirequest. My belief is that in the upturn of a cycle, they can have multiple years of +20% growth with some outstanding margins. They will grow, but the average size of the staffing companies in the US won´t, so they won´t even need the credit line.

I think a good framework to understand a company like this is the software acquirers. Software acquirers like Constellation have the advantage that they buy small companies with very good margins at very good prices. They can operate the corporate model (integration of those companies) because margins are already good.

Hirequest buys intrinsically fragile companies, so they shield their P&L and Balance Sheet by franchising and creating enough incentives for them to be an attractive franchisor (at the end of the day their clients are the franchisees). If you look at their revenues, there is also a “service revenue” which is basically the return they got on their financing.

In conclusion, I believe the Hirequest model will prove successful over long periods. The staffing industry is overlooked as an unsexy sector due to cyclicality and low margins, but here we are talking about a franchise with outstanding margins.

Source: Factset

And it is a franchise that produces enough cash to take advantage of the low part of the cycles and acquire smaller companies. Given the premises that

Hirequest will survive a weak economic environment as they have the balance to do so and

They can take advantage of suffering companies and acquire them to integrate them into their system thanks to their high margins and producing enough cash flows without having to leverage much,

Then returns for such a company should be very attractive for an investor.

I will try to write a little bit more about Hirequest, especially the intricacies of their model and how they have mastered incentive alignment with their franchisees. In the meantime, please do your own due diligence before investing.