Why I would not invest in...Enad Global 7 (EG7.ST)

My notes and rough estimates that led me to discard the investment

In this article, I am sharing my notes and trying to share my thought process when considering an investment. There are no accurate numbers, just rough estimates and an approximation into understanding why the market is given a certain valuation, how much cash needs this business to operate, and how much cash needs to be invested into the business in order to grow.

My conclusion is that the business needs substantial cash inflows to generate growth and to maintain current cash flow generation. This is an inherent characteristic of the sector and despite the undemanding valuation, investing means taking a chance with management, which despite their very good track record, is operating in a difficult and capital-intensive business (thinking about the Buffet quote of the reputation of the business vs management…).

There might be punctual errors as these are just rough notes, feel free to correct me/share your opinion.

Notes EG7:

Enad Global engages in the development, distribution and publishing of digital games. They have a portfolio with popular IPs (Everquest 1 and 2, Planet Side 2, DC Universe, The Lord of the Rings Online, Dungeons and Dragons Online, My Singing Monsters and Mechwarrior 5).

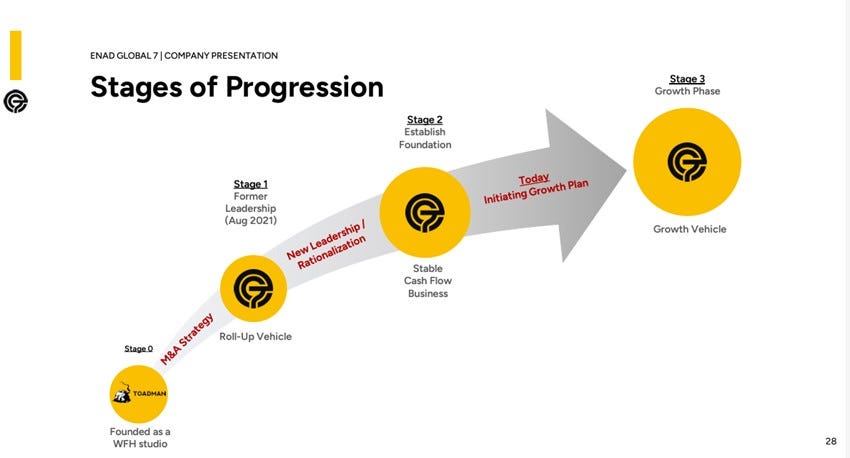

The business can be separated into two parts:

1. The Games segment includes the creation of games and consulting assignments. They have rotated from an independent game developer to a work-for-hire business. This generates less risks and more predictability of cash flows, although, they want to continue to develop their own games. They use a 80-10-10 strategy, which means they use an already proven IP (80%) that has sustained demand in the market, they improve the game 10% and they introduce new characteristics (10%). This strategy is used by the bigger players to mitigate risk. They think they can utilize this strategy and create a space for their products in the middle-market.

2. The services segment refers to consulting activities regarding development strategies and marketing of games, and distributes games as publishers through digital and physically.

Management has made clear that the work-for-hire modality, which will mean predictable cash flows but lower margins, is just a stepping stone into what will be the main source of sales, which is building game franchises on proven IPs from its own portfolio and external IPs.

The route for growth can be separated in two parts:

1. Developing existing IPs into new games (80-10-10 strategy).

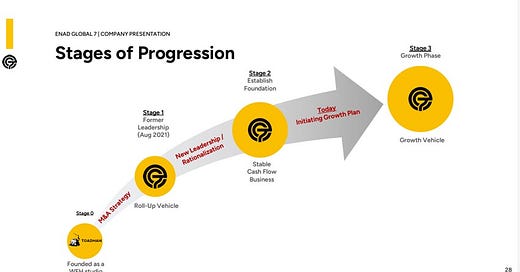

2. Acquiring new IPs existing in the market. Management (which is new since 2022) has a very good track record doing M&A in the space.

There is already a pipeline of future releases during 2024-2026. Note that only part of the capex for these new releases is deployed.

Main challenge: There is a limited number of players in the market that they have to attract to their existing and future games. Any new developments face an unproven demand despite the earlier success of the specific IP.

Right now, they are at a point where they have effectively eliminated any debt (which penalized the stock in the past). They are creating enough cash flows to be able to invest for future value creation.

Also note that despite the publishing segment being a smaller part of the business, it was producing losses until this year, which should help in the future.

The Company is structured as a holding of different companies with specific products and businesses:

Recent changes:

-Profitability is improving thanks to the product mix, but sales on existing games are overall constant/descending. This will continue to be a constant thread as the digital gaming industry is becoming more and more a content-creation industry, where products have limited lifespans. We can see this in the big content platforms right now. The game is about creating the biggest amount of content with the intent to create some hits along the way.

Gaming is a bit different because interactive content has a longer lifespan, but the competitive environment is very similar. It should be even harder for the middle market due to the lower capital available for new developments.

How I approach the valuation of a company like this:

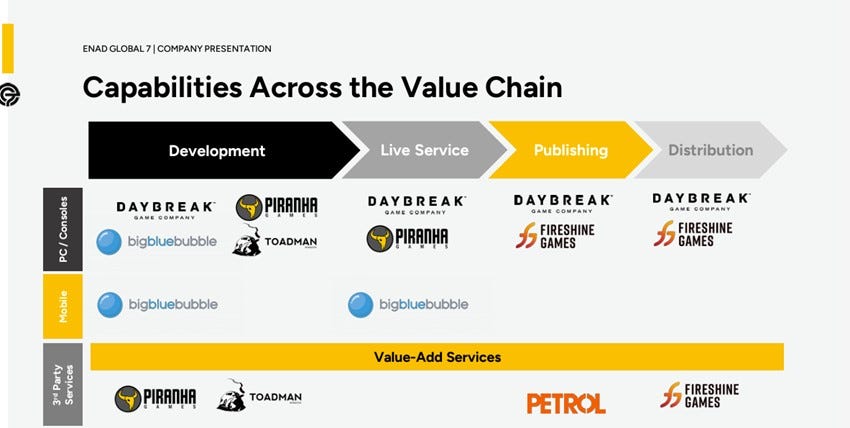

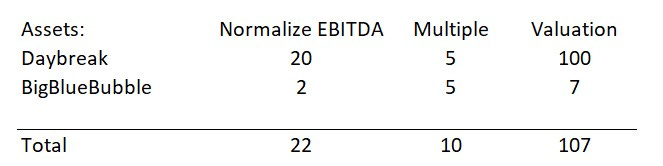

First of all, the Company looks extremely undervalued if you consider adjusted EBITDA and existing cash on hand (35% of the market cap), with no debt. Using a conservative margin we arrive to the following projection without growth:

*The valuation is intended to be as high-level as possible

Funds like Alta Fox (the biggest shareholder) and Atai Capital have bought a position in the Company regarding the potential growth + very undervalued appearance.

My main question when looking at something like this is trying to understand why the market is valuing EG7 at $123m.

There is the already mentioned inherent risks to the business:

-The IPs have limited lives. They have to keep reinvesting into new game editions or buying third-party IPs to develop. This implies a major reinvestment risk. Historically successful IPs can indicate possible future growth when developed but do not guarantee such demand from the market. This can be summarised as that the main source of sales for EG7 is composed of non-recurring revenue.

Given that the business is centered around the development of IPs, it is a good idea to try to understand what the value of those assets is. This is the market value as of right now, without any cash input for future development.

If we apply a multiple of 5x EBITDA, which I consider conservative (they have limited lives), we can approximately say that the IPs are worth $100m without any more cash inputs into them.

For the rest of the operating parts of the Company, I am going to assume zero profits as they are offsetting each other’s, breaking-even. Petrol (the publisher company) can generate around $1m of profits for the year 2023, but I am offsetting this with the losing part of the business. I understand the dynamics of the industry of higher velocity of content creation can favor them, but I want to be conservative and maintain a high-level approach.

Now let’s take a look at cash flows:

If we only consider the $20m-$25m of operating cash flows that the business produces per year (20% to 30% yield), we would be ignoring the substantial amount of cash that needs to go into this kind of business.

How much is to maintain current worth (substitute the declining value of assets) and how much will generate growth is the main question here.

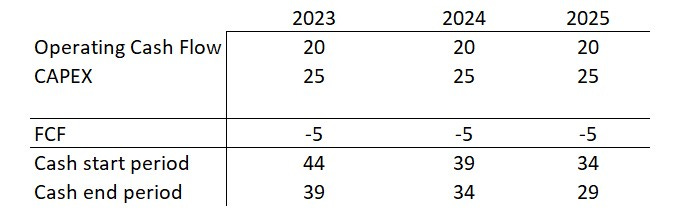

We are talking about maintenance capex vs growth capex. Looking at the cash flows statement, we can see that the minimum required investment that has gone in over the last couple of years in order to grow and sustain current cash production is approximately $16M. They are being a bit more aggressive on their estimates, with an expected output of cash of $25M per annum for the next 2 years.

This will be achievable with their current operating cash flows and cash in hand (another $44m).

I can paint a broad picture given the following assumptions:

-Current assets will produce between $20m-$35m over the next 3 years, although their value will be lower with time. An estimate of $20m for 3 years is conservative.

-To sustain current earnings, the Company needs to deploy between $16m and $25m of capex. Management intends to do $25m to sustain growth.

-No more leverage, so no more financing cash outflows.

-$44m of cash on hand.

*This projection is attributing no value to the growth capex as the CFO is not growing

This level of capital deployment should maintain current assets ($107m) without losing value (capex includes growth above).

The valuation for the Company is $123m, so the market is currently seeing almost no value in the actions of the management team towards value creation. Any upside to current value must come from the growth efforts done by management (the extra $9m invested above maintenance capex if we understand the later to be $16m).

Basically $100m of assets + $20m of value creation.

The market thinks that the current capital deployment by management will be unsuccessful. I do believe management can create value at some point in time, probably because they are overinvesting above maintenance capex to generate growth in their assets, but this growth is not guaranteed and is unpredictable.

Any surprise above negative assumptions for the future of the Company will generate substantial returns for the stock, although it is a tough sector where content creation is inherently very capital intensive, and they are competing against the big players.

Important note: I am considering the latest balance (from 3Q) which does not reflect the value of their latest investments. There are $15M that have already been invested and that are yet to generate some return.

Red(ish) flag: Weird movement by management given their involvement in the latest investment. They are investing $23M into a deal with Cold Iron Studios to acquire the publishing rights of a game they are developing. In the deal, Cold Iron Studios have agreed to pay a Company co-owned by management and EG7 to develop this game, for a value of $8M. So net, they are investing $15M. The deal seems obscure to say the least given that management has some direct ownership of the developer.